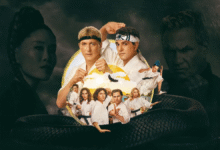

Alice in Borderland Season 3: Everything You Need to Know

Alice in Borderland Season 3 is finally on the horizon! Dive into this comprehensive guide about the release, plot expectations, cast, and everything else you need to know.

The Return of Alice in Borderland: Why Season 3 is the Most Anticipated Yet

The wait is finally coming to an end, and fans are buzzing with excitement. Alice in Borderland Season 3 has officially been confirmed, and if you’re anything like the rest of us, you’re probably counting down the days. Ever since the wild and twisted ending of Season 2, the burning question has been whether Arisu and Usagi’s journey was truly over. Thankfully, it’s not.

Alice in Borderland is one of those shows that sneak up on you with an unassuming start and then leave you breathless. Season 3 promises more of that mind-bending thrill, action, and heart. And if Netflix’s silence has been any indicator, they’re likely cooking up something massive. The stakes are higher, the games deadlier, and the mystery even deeper.

What’s really got fans on the edge of their seats is how Season 2 ended—with a glimpse of the Joker card, a mysterious twist that hints at a whole new layer to the already complex universe. It wasn’t just a cliffhanger; it was a promise. And Season 3 is ready to deliver on that promise.

What is Alice in Borderland All About?

If you’re new to the show or need a refresher, Alice in Borderland is a Japanese sci-fi thriller series based on the manga by Haro Aso. The story follows Arisu, a young man who finds himself transported to a deserted version of Tokyo where he must compete in deadly games to survive. Each game is represented by a playing card, and the higher the card, the more difficult the challenge.

It’s not just the physical trials that test the characters—it’s the psychological battles, the betrayals, and the growing sense of hopelessness. In many ways, it’s a metaphor for survival in the real world, masked with an action-packed, dystopian filter.

The show blends emotional depth with high-stakes tension. The first season gave us the grim introduction to the Borderland. The second season escalated everything with the face-card games, each one more intense and symbolic than the last. And now, Season 3 is expected to blow the lid off everything we thought we knew.

Season 3 Plot Predictions: What Could Happen Next?

So where does the story go from here? With the Joker card now in play, things are about to get even more twisted. In the original manga, the Joker is symbolic, representing a final judgment or reckoning. It could mean the Borderland is not what it seemed, or that another hidden layer is about to be revealed.

One theory is that the Joker represents a return to reality—or at least a confrontation with it. After the events of Season 2, Arisu and Usagi might think they’ve escaped, but the appearance of the Joker suggests otherwise. Perhaps they’re still in the game. Or maybe the game has evolved.

There’s also speculation that Season 3 will dive deeper into the origins of the Borderland. Who created it? Why were these specific people chosen? Are the games random, or is there a bigger system at work? These are the kinds of questions that Season 3 might finally answer, and fans are hungry for those revelations.

Character Development: Who’s Coming Back and What to Expect

While Netflix hasn’t officially revealed the full cast for Alice in Borderland Season 3, it’s pretty safe to say that Kento Yamazaki (Arisu) and Tao Tsuchiya (Usagi) will return. Their chemistry and emotional arc are the backbone of the series.

Arisu has evolved from a lost and apathetic gamer into a determined survivor with a strong moral compass. Season 3 will likely explore his post-trauma state and how he processes everything he’s gone through. Is he still trying to escape the Borderland, or has he become part of it?

Usagi, on the other hand, is the emotional anchor. She’s dealt with her own pain and loss, and her growth has been just as remarkable. Together, they form a powerful duo, not just in surviving but in questioning the very fabric of their reality.

Fans are also hoping for the return of some fan favorites—either through flashbacks or unexpected twists. Characters like Chishiya, Kuina, and even Niragi have left a mark, and their presence in any capacity could add depth and drama to the new season.

The Joker Card: The Biggest Mystery in the Series

Let’s talk about the Joker card. The final shot of Season 2 showing the Joker card sent shockwaves through the fandom. In traditional card symbolism, the Joker is unpredictable, chaotic, and often represents a trickster or wild element.

In the context of Alice in Borderland, it could be anything. Is it a new game master? Is it the final boss? Or is it the embodiment of the entire Borderland? Whatever it is, it signals that the story isn’t over—not by a long shot.

The manga hinted that the Joker represents the ferry man between life and death, a being that determines whether the players go back to the real world or remain in the Borderland. If the show follows this path, we’re in for some seriously philosophical twists and emotional conclusions.

Themes and Symbolism: Beyond the Games

Alice in Borderland isn’t just about survival—it’s a study in human psychology. Each game challenges not just physical ability but mental endurance. Season 3 will likely continue to explore themes like identity, morality, and the essence of free will.

The Joker’s introduction suggests an even deeper symbolic layer. Could Season 3 be more introspective? Could it challenge the characters’ understanding of themselves and their reality? The best sci-fi does more than entertain; it makes us think. And Alice in Borderland is poised to do just that.

The show also borrows heavily from Lewis Carroll’s “Alice in Wonderland,” and it’s clear the creators enjoy playing with that parallel. In this chaotic world, who plays the Queen of Hearts? Who’s the Mad Hatter? These symbolic roles might become more pronounced in the upcoming season.

Visual Effects and Production: What’s New This Time?

If there’s one thing Alice in Borderland nails, it’s the visuals. The CG landscapes of Tokyo, the explosive game arenas, the costumes, and even the color grading—it all adds to the show’s unique style. And from what little we’ve seen, Season 3 will push the boundaries even further.

Fans can expect darker tones, more elaborate sets, and game arenas that are even more brutal. With a bigger budget and growing global audience, Netflix is likely pulling out all the stops. Think of it as Alice in Borderland with a Hollywood twist—but without losing its soul.

One thing that makes this show stand out is its attention to practical effects. While CGI plays a part, many of the stunts and effects are done practically, which adds a raw, visceral feel. That approach is likely to continue in Season 3, giving us more heart-pounding action sequences.

The Manga vs. The Series: Where Do They Align and Differ?

Alice in Borderland Season 3 is expected to loosely follow the manga’s final arc, but there have already been plenty of deviations. That’s actually part of what makes the show so intriguing—you never quite know what’s coming next.

The series has taken liberties with characters, pacing, and even the outcomes of certain games. Some fans love the surprises, while purists have mixed feelings. Still, the changes often add emotional weight or better pacing, which is crucial in a medium like television.

For those who’ve read the manga, Season 3 will likely offer a more visual and emotionally detailed version of the ending, possibly even expanding on parts that were only briefly touched on in the source material. It’s a chance for the story to grow beyond its origins.

Global Popularity and What It Means for Season 3

Alice in Borderland has become one of Netflix’s most successful non-English language series. Its global popularity has surpassed expectations, especially after Season 2. That kind of momentum usually means good things: higher budgets, better marketing, and perhaps even spin-offs or prequels.

The fanbase isn’t just in Japan. From the U.S. to Europe to Southeast Asia, viewers are hooked. This international love means that Season 3 has a lot riding on it—but it also means that Netflix will likely go all-in to ensure it delivers.

The show has also inspired countless fan theories, cosplay, fan art, and discussions on platforms like Reddit and TikTok. It’s not just a show—it’s a phenomenon. And Season 3 is poised to elevate that status even further.

Why Alice in Borderland Season 3 Matters

At its core, Alice in Borderland is about survival, purpose, and transformation. It’s a series that forces its characters—and viewers—to ask the hard questions. What are we willing to do to survive? What does it mean to live? Who are we without our memories or society’s rules?

Season 3 isn’t just another chapter. It’s the culmination of a journey that has captivated millions. Whether you’re here for the action, the mystery, or the emotional depth, there’s something in it for everyone.

And if Season 2’s ending is anything to go by, we’re about to enter the wildest ride yet.

FAQS About Alice in Borderland Season 3

Is Alice in Borderland Season 3 confirmed?

Yes, Netflix has officially confirmed that Alice in Borderland Season 3 is happening.

When is the release date for Season 3?

While no exact date has been announced, many speculate a late 2025 release.

Will Arisu and Usagi return?

Yes, both Kento Yamazaki and Tao Tsuchiya are expected to reprise their roles.

What does the Joker card mean?

The Joker likely represents a final challenge or symbolic transition between life and death.

Is Season 3 based on the manga?

Season 3 will draw inspiration from the manga but will likely have original content and changes.

Can I watch the series without reading the manga?

Absolutely. The show stands strong on its own, and the storytelling is accessible for new viewers.

Is this the final season?

Most likely, yes. Season 3 is expected to conclude the main story arc.

Conclusion: Get Ready for the Ultimate Game

Alice in Borderland Season 3 isn’t just another installment—it’s the grand finale we’ve all been waiting for. With deeper themes, more intense games, and the mystery of the Joker looming large, it promises to be the most mind-blowing season yet. Whether you’re a manga purist or a Netflix binge-watcher, there’s something here for everyone. Prepare yourself. The Borderland is calling once more.